Loan Origination System (LOS)

R2S Loan Origination System (R2S LOS) is a complete and streamlined solution that automates and manages the entire loan lifecycle—from lead generation to credit approval and disbursement. All Processes are dynamically & configurable according to the Loan Product through the Mobile App and Web Application.

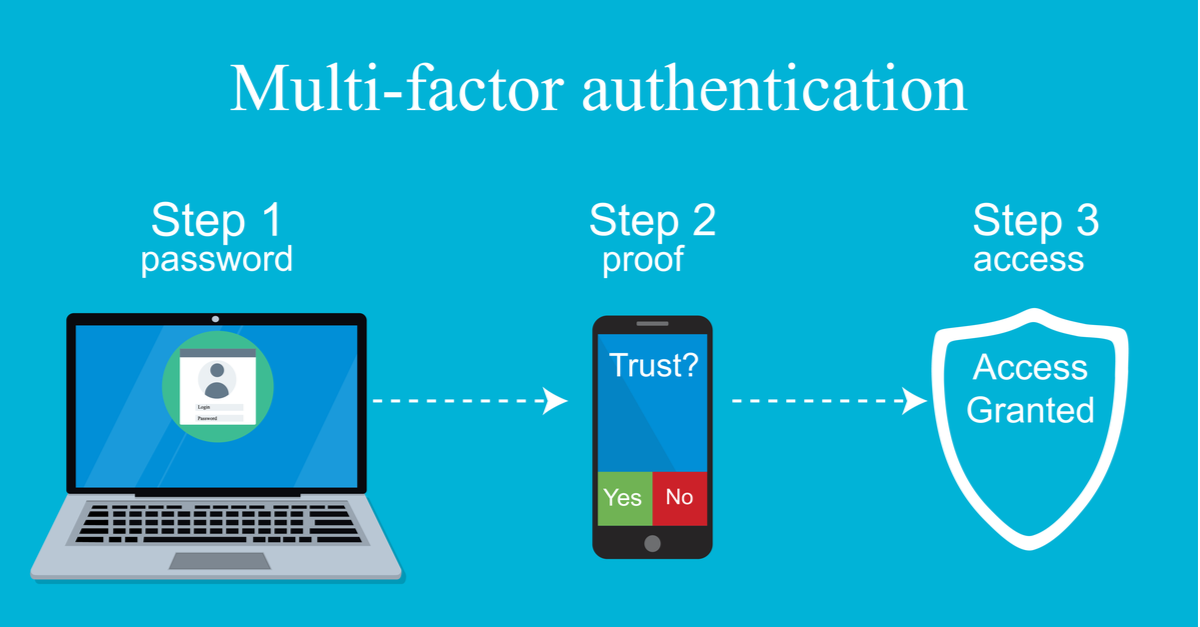

Human Face Detection, Pen & Aadhar Verification, Credit Bureau Integration and Multifactor Authentication -MFA & Data Security are the Key Features of R2S LOS System.

R2S LOS supports

HL, LAP, Vehicle Loans, Gold Loans, Business Loans, Personal Loans, and Microfinance.

Features of R2S -Loan Origination System

1. Lead Generation and Management

In the R2S Loan Origination System (LOS), leads or inquiries can be registered through

multiple channels, including the LOS Mobile App, LOS Web Panel, Company Website,

Third-party integrations, Partners and Walk-in customers. All leads are directed to a centralized

lead dashboard, where they are either automatically or manually assigned to the appropriate

sales executive. The dashboard allows real-time updates and tracking of leads.

Sales executives

received real-time notifications via the LOS Mobile App and Email when a new lead / inqury assigned.

2. Application No Generation & Processing

When a new lead is assigned to a Sales Executive, he receive a real-time notification. The complete inquiry details can be viewed in both the LOS Mobile App and the LOS Web Portal in My Lead section.

Based on the discussion with the customer, the Sales Executive can take appropriate action and convert the lead into a Loan Application by selecting the relevant loan product, purpose, amount, tenure, and rate of interest (ROI).

A unique Loan Application Number is generated for the lead at this stage. The login fee and file processing fee can also be collected at this point.

3. Easy Customer On-Boarding and EKYC

Once the Application Number is generated against the lead, the next step is customer onboarding for the loan application.

The Borrower (Hirer), Co-Borrowers, and Guarantors can be registered by scanning their KYC documents (e.g., Aadhaar Card, PAN Card, Driving License, Voter ID, Passport, etc.).

Both the present and permanent addresses of the customer, along with geo-coordinates, are captured in the LOS App.

At this stage, the Sales Executive also enters the complete asset details and uploads the necessary supporting documents & Images.

The R2S LOS supports both types of customers—Individual and Non-Individual (Firms) throughout the loan process.

4. Verify the Authenticity of Documents Digitally

The R2S Loan Origination System (LOS) includes built-in integration with official government APIs of PAN, Aadhar & Cibil to perform real-time digital verification of identity documents submitted by loan applicants. This ensures compliance, reduces fraud, and enhances operational efficiency. Customer Face Detection is Unique Feature of R2S LOS.

- Real-time validation inside the LOS.

- API results shown to loan officer/executive for immediate decisioning.

- API data logged and linked to the applicant’s loan profile.

- Secure handling of sensitive data with encryption and role-based access.

5. Automated Workflow Models According Products

The R2S Loan Origination System (LOS) supports fully customizable workflow models for each loan product.

This flexibility allows lenders to design and configure loan processing flows tailored to the specific requirements of different products.

Key process steps such as TVR, FI, Legal, Valuation, and Pre-Credit process can be optionally included or skipped based on the configuration of each loan product requirements.

6. Rule-Based Credit Assignment and Credit Decision

The R2S Loan Origination System (LOS) supports both process, pre-credit approval and final loan sanction.

We can configure the assignment of the Credit Manager to the loan application rule based by loan product, loan amount, and manual guidelines.

The Credit Manager can approve the loan with terms and conditions if all documents are correct, or can return the application to the branch for submit the additional documents or to add a co-borrower or guarantor if required.

The Credit Manager can also forward the application to higher authority for advice on any loan application.

When the loan is sanctioned, the LOS system will notify the customer and the branch sales executive for further file processing.

7. Multifactor Authentication (MFA) & Data Security

We understand the importance of loans and customers data to a lending management company. To ensure data security, we have implemented role-based data access with multi-factor authentication. All APIs are secured with the latest token-based encryption and SSL on both, client and server sides encryption. Additionally, we store sensitive customer data in an encrypted format in the database, in compliance with regulatory guidelines.