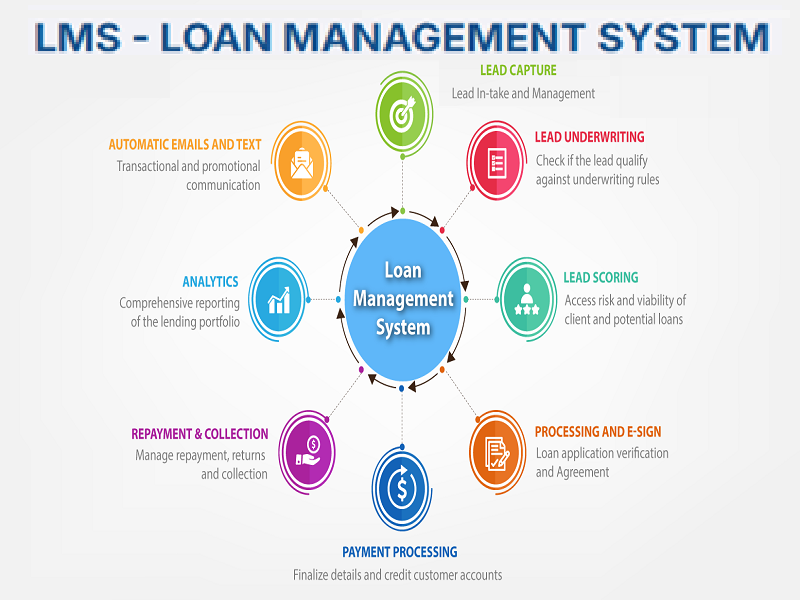

Loan Management System (LMS)

R2S Loan Management System (R2S LMS) is a complete, end-to-end platform that automates and streamlines the entire loan lifecycle—from application and credit assessment to disbursement, repayment tracking, loan restructuring, loan rescheduling, and loan closure. Designed for NBFCs, HFCS, Microfinance Institutions, and Fintech Lenders and its fit for HL, LAP, Vehicle Loans, Gold Loans, Business Loans, Personal Loans, and Microfinance Products., R2S LMS boosts operational efficiency, ensures regulatory compliance, and enhances the borrower experience through real-time data insights, customizable workflows, and integrated analytics.

Features of R2S -Loan Management System - LMS

1. Key Features of R2S - LMS

- Specially Designed for NBFCs, HFCs, and Microfinance Institutions.

- Support to Home Loans, Loan Against Property, Vehicle Loans, Business & Gold Loans.

- Supports Multi-tranche Disbursement, Loan Restructuring, and Loan Rescheduling.

- Motiram Integration & Co-Lending Partnerships Options.

- Loan Accounting & Real-time Portfolio Management & Tracking.

- Easy & Flexible Repayment Option (Single & Bulk Posting & NACH Integrated).

- Reporting Framwork Including GST & Regulatory Reports and Analytic Dashboards.

- Dedicated Collection Management Software & Mobile Application.

- Easy Implementation, Hosting and Data Migration.

Integrated with LOS System

R2S LOS applications that are ready for disbursement can be seamlessly transferred and registered in the LMS. All data captured in the LOS during various processes is moved into the LMS and validated accordingly.

Easy to Loan Number Generation

In R2S LSM, the Unique Loan Number is generating by combining of the branch code, loan product code, and fiscal year prefix. All required information is captured step by step through a wizard-based interface in the LSM system.

Smoothly Customer Onboarding & eKYC

Customer onboarding is a centralized process. By scanning the Aadhaar card, PAN card, or other KYC docs, customer details can be easily auto-filled and verified at this stage. The system also guides and suggests which documents need to be collected from the customer based on the loan product.

Support All Kind of Loan Produts

R2S LSM supports support all kinds of loan products, including Home Loans (HL), Loan Against Property (LAP), Vehicle Loans, Business Loans, Gold Loans, and Microfinance. It offers flexible EMI options with repayment frequencies of Daily, Weekly, Monthly, Quarterly, Half-Yearly, and Yearly and Custom EMI option can also to be added as per requirements

Multi-Tranche Disbursement & Pre EMI Option

R2S LSM supports both single and multiple tranches of loan disbursement, & DV Vouchers generated accordingly. It also supports Pre-EMI, where a repayment schedule is created for the interest component only during the pre-disbursement phase. Once the final disbursement is made, the actual repayment schedule is generated for the full loan amount.

Loan Restructuring & Rescheduling.

R2S LSM provides full support for loan restructuring and rescheduling, allowing modification of loan terms based on borrower requirements or regulatory guidelines. The system enables changes to repayment schedules, interest rates, and EMI frequencies, with audit trails and regulatory compliance. This helps to manage borrower risk and enhances loan recovery without impacting the overall portfolio.

Easy & Flexible Repayment Option

R2S LSM offers easy and flexible repayment options tailored to meet diverse borrower needs. Supports a wide range of repayment frequencies—including Daily, Weekly, Monthly, Quarterly, Half-Yearly, & Yearly. For lenders, It provides single posting, bulk posting, and NACH trigger functionalities, enabling seamless EMI collection and repayment.

Support Early Loan Closure

R2S LSM fully supports early loan closure, allowing borrowers to repay their loans before the scheduled tenure. The system automatically calculates the POS, Overdues, applicable interest, and any pre-closure charges, ensuring transparency and accuracy. Upon closure, it updates all records, generates and accounting vouchers, with complete audit trail.

Loan Accounting & Ledger

R2S LSM provides a complete Loan Accounting & Ledger module that ensures accurate financial tracking and reporting. The system automatically records all loan-related transactions, including disbursements, repayments, interest accruals, penalties, and charges, maintaining a real-time borrower-wise ledger.

Dedicated Collection Mobile App

R2S LSM offers a Dedicated Collection Mobile App designed to streamline field collection operations. The app empowers collection agents with real-time access to borrower details, EMI schedules, payment status, and collection targets. With integrated GPS and Geo-Coordinates, agents can easily navigate to borrower locations, improving visit efficiency.

GST & Regulatory Reports and Analytic Dashboards

1. Business & Loans Status Reports.

2. Collection & Agent-wise Performance Reports.

3. NPA & Portfolio-at-risk (PAR)Reports.

4. Account Statment, Trail Balance & GST Repprts.

5. Disbursement Reports and Trends.

6. Balance Charges Reports & Branch-level statistics.

7. Balance Sheet, P&L Reports & Bank Statment Reconcile.

Autorun EOD & BOD Services

R2S LSM supports automated End of Day (EOD) and Beginning of Day (BOD) processes to ensure smooth daily operations and system consistency.

Handle activities such as:

1. Interest accrual and EMI due calculations

2. Penalty and overdue updates

3. Ledger updates and status changes

5. Task scheduling and alerts for the upcoming day

6. Data backups and report generation